The TL;DR

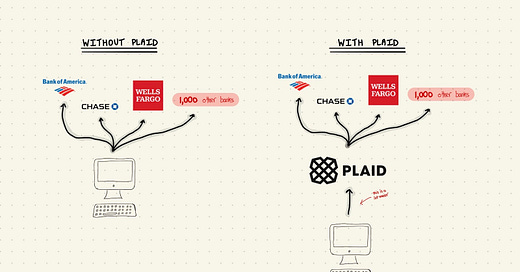

Plaid acts as an intermediary between apps (like Venmo) and your bank so that you can log in and share data securely.

As more and more personal finance apps (think Robinhood, Venmo, Current, etc.) pop up, developers need ways to connect to and access your bank accounts

That connection is notoriously difficult - each bank has its own idiosyncrat…

Keep reading with a 7-day free trial

Subscribe to Technically to keep reading this post and get 7 days of free access to the full post archives.